Ecommerce Buy Now Pay Later Companies: A Beginner’s Guide

What is Buy Now for eCommerce?

Over the past few years, Buy Now Pay Later, or ‘BNPL’, has exploded onto the e-commerce scene and its influence has only grown ever since. BNPL’s services allow customers to purchase goods or pay the installments later, with no additional fees and usually no interest rate.

Buy now pay later is not entirely. brand new idea. Some say credit cards offer a similar function: you can buy things directly and then pay your credit card provider. BNPL usually differs from this, as no interest is charged if customers pay through one of the standard methods (eg in 3 monthly installments). BNPL is similar to one of the standard German eCommerce payment methods – ‘Kauf Auf Rechnung’ – which means ‘purchase on invoice’. Although ‘Kauf Auf Rechnung’ has never been popular outside of German-speaking countries, BNPL suppliers such as Klarna have found great success, primarily through fashion retail websites, especially in packaging and catering to younger customers.

The main players in BNPL vary by region, but generally Klarna, Afterpay (known as Clearpay in the UK), Affirm, Laybuy and PayPal Credit are popular in most regions.

Klarna has become the best known ‘pure’ BNPL supplier. (PayPal is well known, but as a general payment provider). For example, Klarna:

- It works with more than 200,000 merchants in 17 countries

- It manages over a million transactions every day.

- It has sold more than 85 million customers

Klarna’s notable backers include Sequoia Capital (with Apple, Airbnb, Stripe, Square, Instagram) and Visa, the world’s largest payment network.

Terms vary by different providers and in different regions, but generally, Buy Now Later offers customers the option to pay for a period of time, ranging from weeks to years, depending on the provider. While using BNPL, customers pay in full upfront and receive their goods before the payment is completed.

Although buy-now-later providers have only come to prominence in the last few years, their uptake is high: 67 per cent of UK millennials have used BNPL’s options, according to management consultancy Kearney, reflecting its growing popularity in ecommerce. The importance of being considered by retailers.

There are various pros and cons to consider when choosing to add a Buy Now.

Benefits of eCommerce BNPL

Generally, retailers choose to add BNPL to their website or carry it in-store for 3 reasons.

- Now sell to a group of customers who buy BNPL habitually.

- Offer customers the ability to purchase when the full amount is not available (for example, before the due date).

- Match or better the customer experience offered by competitors.

Some buy now later companies offer to market the brands they work with – for example by sending vouchers to potential customers by email – but generally the main decision making is increasing the chances of buying from visitors who are already coming to their site, rather than attracting more visitors.

As mentioned, BNPL is making an impact on buyers and retailers and it is clear that BNPL is poised to become a bigger part of the business online and in-store. For consumers, BNPL offers faster enrollment compared to credit cards, and with little or no interest charges, this mode of payment is very attractive to many. This appeal, in turn, is relevant to e-commerce businesses, as BNPL has proven to attract more custom, larger purchases and shopping cart abandonment, for a number of reasons.

First, BNPL’s checkout options may attract customers who are reluctant to buy things they see out of their budget. Offering a way to further manipulate this price can result in purchases from customers who previously left without making a purchase. Similarly, BNPL allows people to make purchases when their funds are traditionally low, such as before payday or during periods like Christmas. These factors contribute to BNPL reducing cart abandonment after introducing BNPL options, as BNPL simplifies checkout purchases by offering payments at more manageable rates.

Leading supplier Klarna BNPL’s options reveal statistics that highlight the impact it has had on various companies. After giving the option to register with Klarna, Shuh It saw a 40% increase in conversions on mobile and a 25% increase in desktop purchases. Klarna He cites a 15% increase in average order value, and a 20% higher annual customer purchase frequency. These figures indicate that BNPL is having a positive impact on businesses, bringing in higher purchase rates and increasing incentives for customers to return.

Just by admitting, it’s clear that some consumers want to use BNPL options, and staying up-to-date with the methods your customers want to use can be incredibly valuable. Adding BNPL payment methods has been proven to generate revenue for many companies, so adding these providers to your site can increase revenue without using other methods like sales and discounts. There is no risk for the retailer as the BNPL supplier will look at defaults on a case-by-case basis.

Generally, BNPL companies are highly focused on the following verticals:

Perhaps if you are selling in one of the above mentioned areas, your competitors may be offering BNPL options as standard, and a certain number of customers may not be willing to switch to you if that service is not matched.

BNPL for Retailers: Four things to consider:

Along with the advantages of ‘buy now pay later’, there are several downsides to consider.

A: Payments.

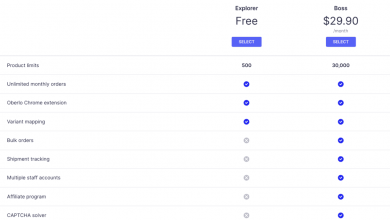

To offer BNPL options, traders have to pay a fixed fee for each transaction and a commission of (approximately) 2-6% of sales made using the provider.

While some sales may ‘grow’ with this method (more than you would expect without it), some customers may switch to BNPL from their normal shopping method, meaning that in some cases retailers pay BNPL for sales companies they would otherwise have made without.

Two: It returns.

Also, offering BNPL options can generate additional profits as many people may buy more than they want to keep, seeing what they like and returning the rest. Keeping this in mind, it is important to ensure that there are effective mechanisms in place to detect and reduce return fraud as companies introducing BNPL options may be more vulnerable to this.

Three: Education.

It is also important to consider that some of your customers may not be familiar with BNPL or how it works, so if you want to use it, it may be a good idea to introduce and educate visitors to the website how this option works.

Four: Profitability.

Finally, when selling products with small profit margins, BNPL may not be profitable for business. After deducting fixed fees and commissions on sales, BNPL may reduce its profits by using this option which will adversely affect the company. It is important to consider this when considering implementing BNPL in your eCommerce site.

How to integrate eCommerce BNPL options:

Most of the providers ask you to connect through their website to offer BNPL options for your own business. Here, you will be asked to fill out forms detailing the countries in which you operate, annual sales and general contact information. Inquiring about BNPL options is quick and easy, meaning you can look at the pros and cons of different providers before committing to one or more providers.

Final Thoughts:

As a payment method that is only a few years old, BNPL is making a huge impact on e-commerce. Some of the big online retailers also offer BNPL options ASOS, Wayfair, JD Sports And Nice little thing. Accordingly, BNPL cannot and should not be ignored. It may not be the right choice for every e-commerce store, although keeping up-to-date with customer payment methods is vital to satisfying customer needs and generating more sales. It is likely that BNPL is only increasing in popularity when it comes to e-commerce, so keeping an eye on this could be beneficial for many retailers.